(for NRIs and Foreign Nationals)

Professional Fees for Company Incorporation including Name Search and Reservation, MOA & AOA preparation, Incorporation Application, DIN, PAN, TAN, Assistance in opening bank accounts

NOTE: DSC procurement and any Out-of-pocket expenses are billed based on actual costs.

* Prices are higher for Private Limited Company Registration in Kerala, Madhya Pradesh and Punjab on account of higher stamp duty.

Are you planning to expand your business and exploring options for Company Registration in India as a foreign entity? One of the most efficient and globally trusted structures for foreign companies is registering a Private Limited Company in India. Unlike structures such as proprietorship, partnership firm, or OPCS, foreign direct investment (FDI) is not only allowed in private limited companies, it is also allowed through the automatic route. This means that the process is streamlined and less time-consuming.

A private limited company also offers strong advantages, including limited liability protection, easy ownership transfer, high credibility, and the flexibility of a partnership combined with the stability of a corporate structure. This makes it the preferred choice for foreign businesses, startups, and investors looking to build a long-term presence in India.

At VenturEasy, we specialize in helping foreign nationals, NRIs, and overseas companies complete their Company Registration in India seamlessly. From drafting documents to compliance management, from obtaining approvals to assistance with opening a local bank account - we handle everything end-to-end so you can focus on building your business.

NOTE: All the above documents should be notarized by a Public Notary and Appostilled/Consularized by the Competent Authority of the foreign country.

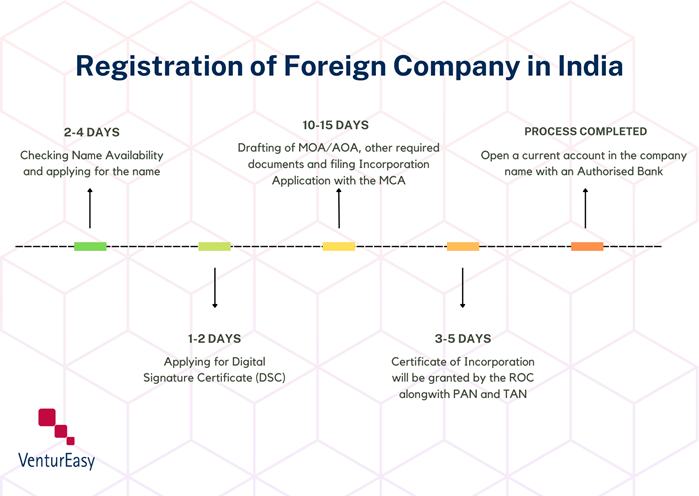

It usually takes 15-20 days to complete a Company Registration in India, subject to ROC processing time. VenturEasy makes the process simple and smooth for foreign businesses. Registering a foreign company in India follows an easy three-step process with expert assistance at every stage:

2-4 working days

1-2 working days

10-15 working days

List of Incorporation documents to be executed:

Generally, the incorporation documents are required to be self-attested by Indian Nationals. However, in case of Foreign Nationals, the process is as under:

If the documents are signed outside India, then the same have to be notarized by a Public notary of the residence country and consularized or apostilled by the competent authority, as the case may be.

If the documents are signed in India, then copy of Visa and stamped passport, proving his/her presence in India at the time of signing is required.

If the subscriber is a foreign entity, then the Incorporation documents should be signed by the representative of the foreign entity. An Authorization Letter duly stating the name of the Authorized Person and the number of shares subscribed should be notarized, consularized or apostilled, as the case may be in the home country of the subscriber company.

Once the Incorporation application is approved, the Registrar would issue a Certificate with a Corporate Identification Number (CIN). The PAN and TAN of the Company would also be allotted simultaneously.

We had our Indian subsidiary set up by VenturEasy - and as the name describes, they make the process really easy! Communication was clear and timely, fees we're very reasonable and overall it has been a painless process. I will continue to use their tax and accounting assistance and would recommend their services to anyone also going through the process of setting up a company in India.

I am writing to thank you for the quality of service provided by your company. We sincerely appreciate your efficient, gracious customer service, the support and guidance you have accorded us on our journey to incorporate our company in India, and the way you conduct business. We are thrilled for making it a reality.

We have, and will continue to, recommend your service to other companies and contacts who may need your services..