Due to India’s booming industries, its huge consumer market made it an ideal destination for foreign investors hoping to extend their commercial ventures elsewhere. Subsidiary registration in India is a complex process, involving compliance with government regulations, tax laws, and corporate governance norms. Starting a subsidiary company in India is a strategic decision that comes with multiple legal hurdles and regulatory requirements. This article will help to reveal the specifics of the Indian Subsidiary Company Registration – so just catch up with us to see how it works!

Definition of an Indian Subsidiary Company

In India, a subsidiary company is an autonomous legal structure set up by the overseas parent company to operate there. That is, it’s an independent entity in law from its mother concern which permits independent management and operation but retains an Indian personality.

As per FEMA Guidelines NO FDI is allowed for proprietorship, partnership firm & one person company. Investment in LLP’s can be made however it is subject to the earlier approval of RBI.

As such, the most convenient and simple form of business enterprise in India for foreign subsidiaries is establishment of private limited company.

Minimum requirements for Indian Subsidiary Company Registration:

- Capital: There is no minimum capital required to form a Private Limited Company in India.

- Directors: To establish a Private Company in India at least two directors are required. Both should be individuals with one such person being an Indian resident’. (The residential status and other relevant conditions that are required for a person to be identified as an Indian resident during this year of assessment include being present in India for not less than 182 days within the said financial year.

- Shareholders: Private limited firms should have no less than two shareholders in accordance with the Companies Act, 2013. Shareholders have no residency condition. There may be one or more shareholder i.e. individual, organization/s, or a combination of both.

Check list of documents for subsidiary registration in India:

- For Indian Resident Director: Photocopy of PAN card, Photo Copies of Aadhar card, Copy of passport/voters ID/driving license and Bank Statement / Electricity/ Telephone bill in address (not more than two months old) are necessory document for Indian subsidiary company registration.

- For Foreign Directors/Shareholders and Authorized Representative of Foreign Company Photograph, Copy of Passport, Copy of Driving License, Bank Statement/Electricity/Telephone bill in the country of residence – not older than two months.

- For Indian Company: Address Proof of Proposed Place of Business(Rental Agreement, Utility bill (electricity or phone for the premises) – Not more than two months old; NOC to use the premises as a registered office.

When engaging in Indian subsidiary company registration, it’s important to fulfill all the necessary legal requirements and documentation.

Procedure of Subsidiary Registration in India:

Step 1. Name Approval:

The very first step on your road map, is making a company’s name reservation prior to Subsidiary Registration . For a subsidiary company, it may be allowed to use the same title as of the parent company but adding the word ‘India’ at the end of it. A name is approved, unless identical with existing ones or being inadmissible under law.

Step 2. Procurement of DSC:

Simultaneously, the Company’s proposed directors will be issued with their Digital Signature Certificates. Such DSC shall be utilized in filing the registration application digitally and will also form part of future compliance reporting process.

Step 3. Subsidiary Registration Application:

This is the last stage of the Subsidiary Registration procedure. The same entails filing at the Ministry of Corporate Affairs of the Memorandum and Articles of Association of the Company along with other undertakings that are in order from the prospective directors and shareholders.

List of Subsidiary Registration documents to be executed:

Articles of Association

Memorandum of Association

Form DIR 2 declaration from directors.

Form INC-9 – Declaration of Directors/Shareholders and Authorized Representative.

Foreign Company/Directors – PAN Undertaking.

Usually, Indian nationals have to attach their passports or driving licenses to their incorporation documents.

However, in case of Foreign Nationals, the process is as under:

The documents that are signed outside India should be notarized by a Public notary of the resident country, consularised or apostilled by the concerned authority, in respective.

For all the documents signed in India the author should provide a copy of Visa and stamped Passport confirming his or her physical presence in India at the time of signing.

If the subscriber is a foreign entity, then the registration documents should be signed by the representative of the foreign entity. An Authorization Letter duly stating the name of the Authorized Person and the number of shares subscribed should be notarized, consularized or apostilled, as the case may be in the home country of the subscriber company.

Following approval of the subsidiary registration application, the Registrar would issue a Certificate bearing a corporate identification number(CIN). It means that Company’s PAN and TAN would be issued by the same date.

Treatment of Share Capital invested by the Holding Company and required compliances:

The guidelines, formulated by RBI and FEMA, govern foreign investments into Indian firms. Any time the holding company invests funds in the share capital of an Indian subsidiary, it must observe the RBI guidelines as well as any laws of India’s Companies Act 2013.

Our Subsidiary Registration services are specifically designed for all kinds of business, irrespective of its nature; we appreciate that no two businesses are alike. In line with this, we aim at assisting foreign firms set up their business effectively in India to benefit from the numerous opportunities within the country.

Should you want to know more on Subsidiary Registration in India, kindly email us today. Let us make your success story in India. Please drop us an email at hello@ventureasy.com with your queries/ requirements.

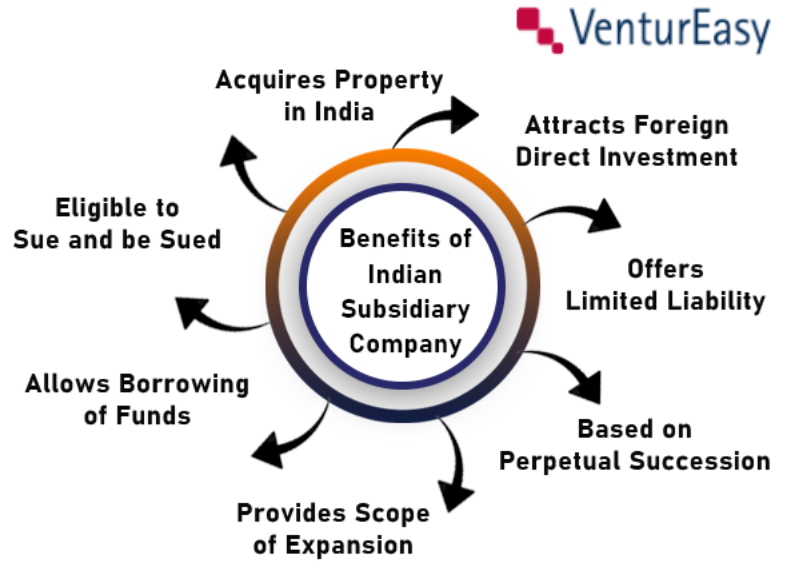

BONUS: Why Should One Register a Subsidiary in India?

Market Access

The establishment of an Indian subsidiary opens a gateway into what is considered as one of the largest and fastest growing market in the word. This allows foreign companies entering Indian market through operations in India.

Limited Liability

Limited liability is one of the main advantages of a subsidiary company. Only the parent’s assets are exposed; these include assets owned by the subsidiary that operates, as a shell company, outside of the jurisdiction of bankruptcy law, thereby shielding the parent from litigation.

Taxation

Their Indian subsidiaries may take advantage of numerous tax exemptions and treaty provisions that may reduce their cumulative tax burden. Nevertheless, understanding the intricate India’s tax system is important when it comes to leveraging all these benefits.

Compliance and Governance

Operating a business through registered subsidiaries means compliance with local Indian laws. However, such compliance is imperative to ensuring that the company operates within local regulatory frameworks and also builds confidence, trust, among Indian partners, customer’s and stakeholders.

We also assist our clients regularly with Compliances for a Private Limited Company in India and Compliances for Subsidiary Companies In India

- Subsidiary Registration in India: Navigating the Legal Landscape - December 8, 2024

- Incorporation of Foreign Subsidiary in India - November 30, 2024

- Compliances for Subsidiary Companies In India - November 23, 2024